To Create Wealth, Apply the 75/25 Rule

If an average African makes money, the first set of things he will think about are his needs. New shoes, new clothes, special birthday party, special remembrance for his father that died in 1980 etc. He spends, he does not multiply.

To order, call 07032681154

Kindly tell me what you did with last month’s salary. Kindly tell me what you’re planning to do with this month’s salary.

Dear business owner, how much have you made this year? What did you do with the money? By the way, did you place yourself on salary or you just collect any amount of money you like while going home every evening?

We have consumer mentality. We have spending mentality. We spend money before we even make it. Someone who is reading this now has planned how to spend the money he will make next month in advance. The moment the money reflects in his bank account, he will start transferring it immediately.

To sign up, call 07032681154

There are Two Sets of People On Earth:

When a wealthy man makes money, the first thing he will think about is how to multiply it. So, when he makes $10,000, he will invest or allow it to keep appreciating in his business. Two years later, the $10,000 has become $100,000.

When a poor man makes money, the first thing he will think about is what to spend it on. He goes on a spending spree. Two years later, the $10,000 is now outdated shoes, clothes and smartphones. Wealthy people invests their money, poor people spends money.

What is 75/25 Principle?

If you make money from today, endeavor to save 75 percent of it, and budget on how to spend the remaining 25 percent.

Let’s assume you made $10,000. The moment the money reflects in your bank account, tell yourself that your share is $2,500! In fact, don’t even see $10,000. See just $2,500.

If you are a business owner, it means $7,500 will enable you to purchase more products than you used to purchase in the past.

To order, call 07032681154

For some people, you don’t even need to spend up to 25 percent of your income because of the volume of your income. Someone that makes money daily and monthly like Elon Musk, Jeff Bezos, Mark Zuckerberg and others, will not spend up to 5 percent of his income.

Online Advert is a Trap

Social media is designed to trap you. It is designed to control the way you think and behave.

For example, different social media apps are listening to your conversations. If you mention shoes while talking to someone on the phone, and later open your social media app, you’ll start seeing shoes adverts. It is algorithm. They are monitoring you.

These people monitor your online behavior. They study the kind of posts you like, the kind of people you interact with, the kind of things you post on social media etc. That is why they show you adverts of the things you like on your timeline.

To order, call 07032681154

That is why you scroll past three posts and the next one will be advert. They are enslaving people. They are turning people to consumers instead of investors.

If it is possible, kindly stop shopping online or discipline yourself in that regard. If you look back you will discover that you are now buying things you don’t need. You are now addicted to shopping. Social media owners programmed you that way. They are making money from your unguarded spending.

To be wealthy you must fight waste. Fight it with all your might. Say no to waste. Say no to unnecessary expenditures.

Instead of organizing a party to impress others, save the money. Open school fees accounts for your children. Instead of buying things you don’t need, save that money and invest it.

Learn how to spend from a budget. Impulsive buying should end today. If it is not in your budget, don’t buy. I know it won’t be easy for starters, but you will master it with time.

An unknown author said, “The person who doesn’t know where his next dollar is coming from usually doesn’t know where his last dollar went.”

Charles Dickens said, “Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.”

Jack Benny opined, “Try to save something while your salary is small; it’s impossible to save after you begin to earn more.”

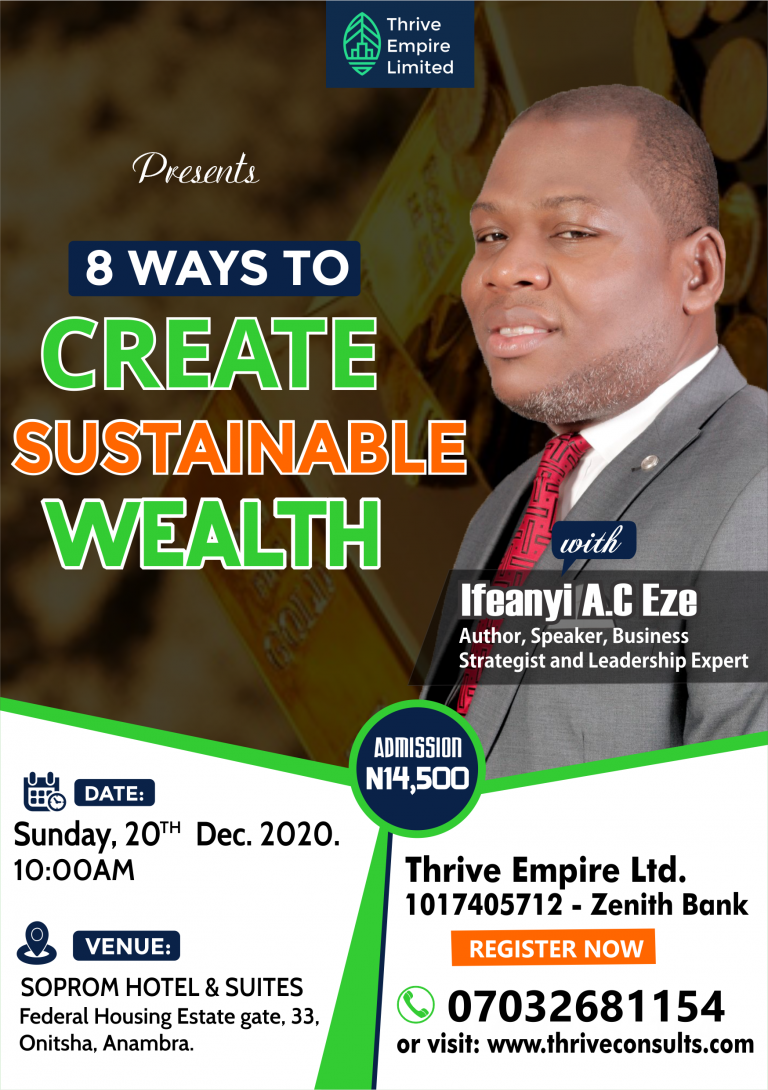

To learn more about making, managing and multiplying money, order my books, 15 Laws of Money, Business Growth and Expansion Secrets and Road to Success. Also sign up for our Financial Management coaching immediately. Call 07032681154 or chat with me wherever you read this.

What did you learn today? Share your thoughts with others at the comment section below.

See you at the top!

Copyright 2022: www.ifeanyieze.com. Reprint, curation, adaptation, or reposting this article without the consent or approval of www.ifeanyieze.com is a copyright theft.

To order, call 07032681154

Sir, All your textbooks mentioned above. I have read all more than once. They are financially educational and instructional. My life have turned around financially because, I am presently practicing most of what the books are teaching financially. I advise and encourage those who have not read them to buy the books now. You will be glad to have them.

OBUMNEME ALEXANDER ONOVO, LAGOS STATE NIGERIA.