This Is Why Some People Can Never Be Rich

The primary reason for financial problems in life is lack of self-discipline and self-control. It is the inability to delay gratification in the short term. It is the tendency for people to spend everything they earn that guarantees their permanent stay at the city of penury.

According to insurance industry statistics, if one hundred people starts work at age twenty-one, by age sixty-five, one will be rich, four will be financially independent, fifteen will have some money put aside, and the other eighty will still be working, broke, dependent on pension, or dead.

I stated in my book, Twelve Pillars of Financial Success that the primary reason why most adults have financial problems is not low earnings. For example, two individuals that are living on the same street, in the same size of house, and working in the same job can have completely different financial situations.

In fact, by the age of forty-five, one of them will be financially independent while the one next door will be deeply in debt and struggle financially. The reason for this is not the amount of money that they earn. The reason is lack of self-discipline and the inability to delay gratification.

Your money habits will determine whether you are going to become wealthy or poor. If you spend every dime you make on frivolities, you will struggle at old age. It is not how much you make that determines how wealthy you will become, it is how well you manage it

The starting point of achieving financial independence is to discipline yourself to rewire your attitude toward money. You need to reach into your subconscious mind and disconnect the wire linking “spending.” You need to then reconnect the wire of savings and investment.

To reinforce the shift in thinking, open a financial freedom account at your bank. This is the account in which you deposit money for the long term. Once your money goes into this account, you resolve that you will never spend it on anything except the achievement of financial freedom.

If you want to save money to buy a car, you open a separate account solely for that purpose. But your financial freedom account is untouchable. You never touch it except to invest those funds so that they can yield a higher rate of return.

When you begin saving in this way, something miraculous happens within you. You start to feel happy about the idea of having money in the bank.

Even if you open the financial freedom account with just $1 (N365), the action will give you a feeling of greeter self-control and personal power. You feel happier about yourself. The very act of disciplining yourself to save money makes you feel stronger and more in control of your destiny.

Each time you get some extra money, you put it into your financial freedom account. Eventually, your financial freedom account will begin to grow.

One of my greatest discoveries in life is that the more money you save in your financial freedom account, the more energy it generates in you, and the more money you attract. As you begin to save and accumulate money, the law of attraction will be ignited to work on your behalf.

The reason why many are not saving is their believe that one day God will make them rich without their input. They keep waiting for their breakthrough until everything around them breaks down.

Responsibility remains the price of greatness. Run to the bank right now and open a savings account. Discipline yourself not to touch a dime from it no matter the pressure. If you save N1,000 daily from the first day of every year, you will have N365,000 at the end of that year. The choice is yours.

For more on finance and wealth creation, order for my books, Twelve Pillars of Financial Success, 15 Laws of Money and Increasing Your Capacity for Exploits.

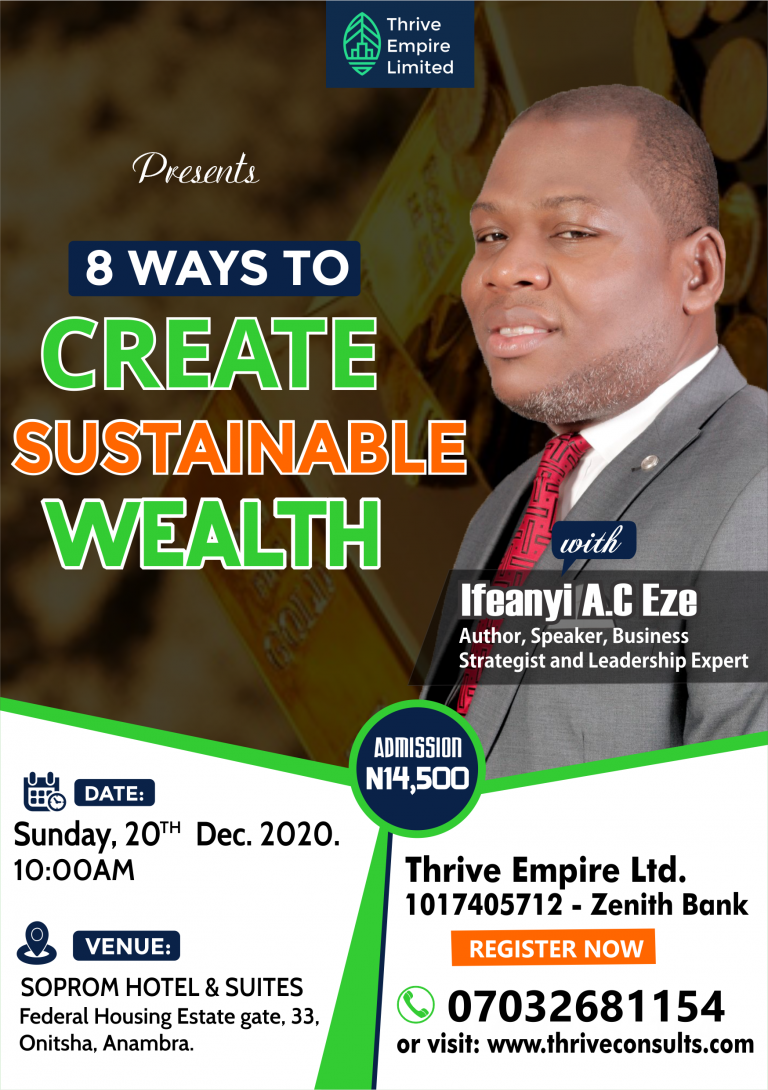

For one on one coaching on finance, scroll up, click on coaching, and then click on the finance button and sign up, and we will take it from there. You can also call Goodwin on 07032681154.

Keep soaring!

Copyright 2018: www.ifeanyieze.com. Reprint, curation, adaptation, or re-posting this article without the consent or approval of www.ifeanyieze.com is a copyright theft.

I need the books as you mentioned.

How and where will I see them to buy.